Pricing

How pricing works

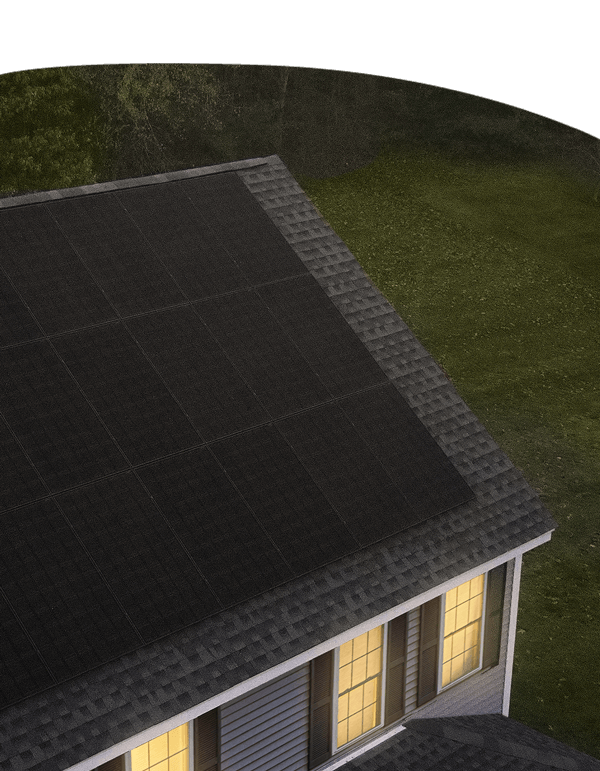

We’re making sure you’re getting the best-looking system with the most proficient panels installed by our expert team. We know that every detail matters when it comes to your home, and with our flexible payment options, you can increase the value of your home while saving on monthly bills.

Significant Savings

Low monthly payments, full maintenance, and warranty coverage.

Flexible terms, full maintenance, and warranty coverage.

Maximize monthly savings, full warranty coverage.

Compare Payment Options

Features | Monthly Lease Get a Quote | Finance to Own Get a Quote | Outright Purchase Get a Quote |

|---|---|---|---|

| Summary | Lowest cost, immediate savings | Flexible ownership option. Own your system with no upfront cost. | Own your system |

| Upfront Payment | $0 Down* | $0 Down* | Full system cost |

| Ownership | You | You | |

| Monthly Payments | Low lease payments | Fixed | None |

| Payment Terms | Monthly payments | 5-25 Years | None |

Benefits | Monthly Lease | Finance to Own | Outright Purchase |

|---|---|---|---|

| Included Care & Maintenance | |||

| Energy Monitoring | |||

| 25 Year System Warranty | |||

| Tax Credits | |||

| Property Tax Abatement |

*Zero down options are subject to credit approval. We make no guarantees that someone will qualify for a zero down option. A potential borrower must undergo a credit check to determine what options are available.

It's Never Been

Better To Go Solar

With our flexible payment options combined with your state incentives, local rebates, and the Federal Investment Tax Credit, you’re paying next to nothing for the best solar panel system available.

How much can you save?

Based on your local incentives, we’ll prepare a free quote that shows what you can save from the start. Fill out the form below or give us a call today, 1 (888) 522-9161.